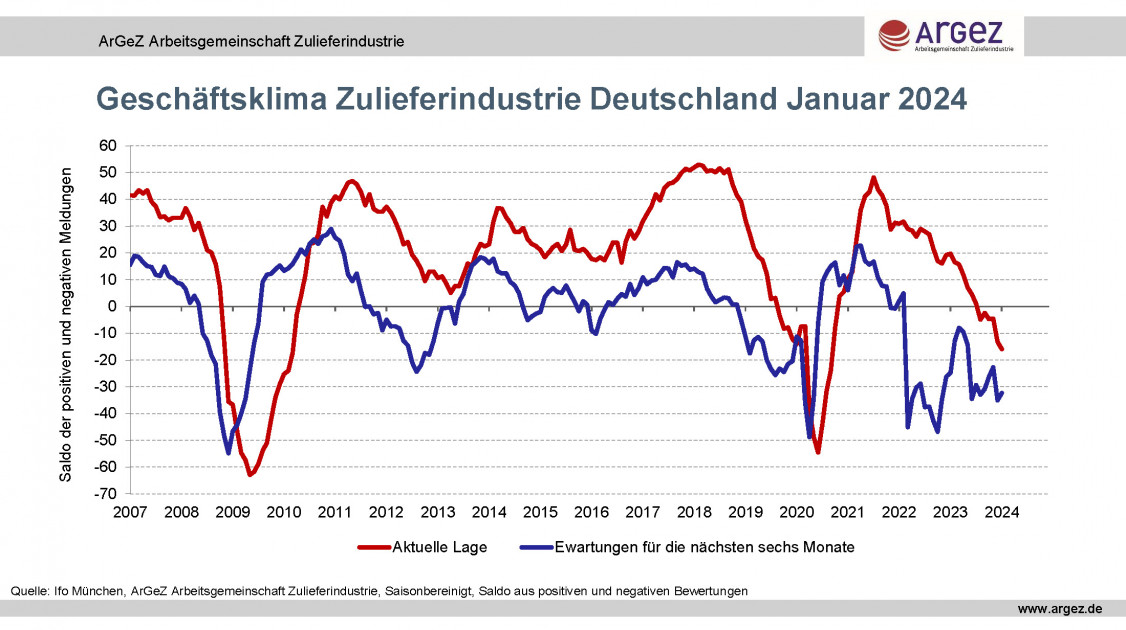

The business climate for German suppliers is treading water at the start of the year. Due to the marginal improvement of 0.2 points, the ifo value stood at -24.3 points in January. By comparison, the value in January 2023 was still -3.8 points. Although expectations were already pessimistic a year ago with a balance of -24.7 points, the outlook for the next six months is now even gloomier with a balance of -32.3 points. The fact that this is no longer just a warning signal is illustrated by the assessment of the current business situation, which deteriorated again in January and has now reached -16.0 points due to the 2.8-point decline in the balance of good-bad assessments. The last time German suppliers rated their business situation worse was 40 months ago, in the lockdown year 2020.

Just how serious the situation is was also evident at the 27th ArGeZ Supplier Forum on January 25 in Frankfurt. Over 100 German suppliers joined representatives from politics, trade unions and the customer side to discuss the prospects for the industry. Right at the beginning, those present addressed the question of Germany as a business location. "We need a double whammy to create the necessary framework conditions for energy-intensive SMEs," explained Dr. Klaus-Dieter Bauknecht, Chief Economist at IKB Deutsche Industriebank. "If we want to achieve the transformation to digitalization and climate neutrality, the investments would have to be significantly higher." Hartmut Höppner, State Secretary at the Federal Ministry for Digital and Transport Affairs, rightly pointed out that the problems did not just arise during the current legislative period, but he was nevertheless forced to acknowledge that trust in the government is at an all-time low and that urgently needed investments are failing to materialize due to poor economic policy conditions. Jürgen Kerner, 2nd Chairman of IG Metall, made it clear by vehemently calling for the need for a bridge electricity price for energy-intensive SMEs and a fundamental rethink of approval procedures. Other topics included diversification opportunities in the supplier industry and the advantages and opportunities of the circular economy in the automotive sector.

The supplier industry business climate index is determined by the supplier industry working group ArGeZ in cooperation with the Ifo Institute, Munich. It is based on a survey of around 600 companies and covers the foundry industry, aluminum industry, plastics processing, steel and metal processing, non-ferrous metals industry, rubber industry and technical textiles. The chart, with corrected seasonally adjusted data, is available for download at www.argez.de.